In this captivating journey, we will delve into the historical evolution, key players, and regulatory landscape of Israel’s thriving crypto ecosystem, shedding light on its contributions to the global blockchain revolution.

Israel’s Crypto Landscape: A Historical Overview

The history of cryptocurrencies in Israel dates back to the early days of Bitcoin’s emergence. As Bitcoin gained popularity worldwide, it gradually made its way into Israel, captivating the interest of tech-savvy entrepreneurs and early adopters. In 2013, the Israeli Bitcoin Association was established, serving as a central hub for enthusiasts and promoting the adoption of cryptocurrencies across the country.

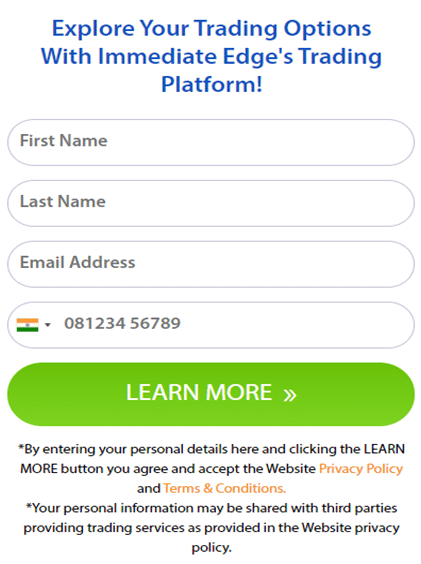

Since then, Israel has witnessed several significant milestones that have propelled its crypto scene forward. Israeli entrepreneurs recognized the potential of blockchain technology beyond cryptocurrencies and started developing innovative projects. One notable example is Colu, a startup that aimed to create local digital currencies to boost economic activity in specific communities. Moreover, trading crypto currencies was never so easy before the advent of trading bots. Immediate Edge can help you with this and click the image to start trading:

The Israeli government and regulatory bodies have also played a crucial role in shaping the crypto landscape. In 2017, the Israeli Securities Authority (ISA) issued a statement categorizing cryptocurrencies as financial assets subject to regulations. This move aimed to protect investors and establish a clear framework for businesses operating in the crypto space.

Furthermore, the government’s supportive stance toward blockchain technology has fostered collaboration between academic and research institutions and the industry. Israeli universities have actively pursued research in blockchain and cryptocurrencies, with the Technion-Israel Institute of Technology leading the way. Researchers have explored various aspects of blockchain, including scalability, privacy, and smart contracts, contributing to the global body of knowledge in this field.

Over the years, Israeli startups have emerged as key players in the global crypto industry. Companies like Bancor, Sirin Labs, and Orbs have made significant contributions, developing cutting-edge solutions and platforms. These startups have attracted substantial investments from venture capitalists and have become synonymous with Israel’s innovation prowess.

Israel’s crypto landscape hasn’t been without its challenges. Regulatory uncertainties and concerns surrounding money laundering and terrorist financing have led to cautious approaches and occasional setbacks. However, the Israeli government has shown a willingness to foster innovation while ensuring the safety and integrity of the financial system.

Key Players In Israel’s Crypto Ecosystem

Israeli startups have been at the forefront of driving innovation in the crypto industry. Companies like Bancor, founded in 2017, have made significant contributions to the decentralized finance (DeFi) space. Bancor introduced the concept of automated market makers (AMMs), revolutionizing token exchange by enabling users to trade directly from their wallets without relying on traditional exchanges. The platform gained widespread recognition and became one of the most successful initial coin offerings (ICOs) in history, raising over $150 million.

Another notable Israeli crypto startup is Sirin Labs, which focuses on developing secure and user-friendly blockchain-based smartphones. The company’s flagship product, the FINNEY, integrates a built-in cold storage wallet and a secure blockchain ecosystem, providing users with a seamless and secure mobile experience for managing their cryptocurrencies. Orbs, founded in 2017, is a blockchain infrastructure platform that offers scalability, security, and interoperability solutions for decentralized applications (dApps). By providing a developer-friendly environment and robust infrastructure, Orbs aims to drive the mass adoption of blockchain technology by addressing key challenges faced by dApps, such as scalability and transaction costs.

Israeli universities and research institutions have actively engaged in blockchain research and development, contributing to the advancement of the crypto ecosystem. The Technion-Israel Institute of Technology, renowned for its technological expertise, has established itself as a leading institution in blockchain research. Researchers at Technion have made significant contributions to areas such as consensus algorithms, privacy-enhancing technologies, and smart contracts. In addition to Technion, other academic institutions, including Tel Aviv University and the Hebrew University of Jerusalem, have initiated collaborations and research projects exploring the potential applications of blockchain technology across various domains. These institutions serve as a knowledge hub, fostering the development of talent and nurturing future leaders in the crypto industry.

The Israeli government and regulatory bodies have recognized the importance of striking a balance between fostering innovation and ensuring investor protection and financial integrity. The Israeli Securities Authority (ISA) has been actively involved in regulating the crypto industry, providing guidelines for ICOs and exchanges to operate within a transparent and compliant framework. This regulatory approach aims to mitigate risks and establish a stable environment for crypto-related activities.

Conclusion

As we conclude our exploration of Israel’s crypto scene, we witness the impressive contributions of innovative startups, collaborative academic institutions, and a supportive regulatory environment. Israel’s role in shaping the future of finance and technology is undeniable, making it a prominent player in the global crypto revolution.