Social Security benefits play a crucial role in the financial well-being of retirees in the United States. For individuals contemplating retirement, understanding the age at which they can earn unlimited income while still receiving Social Security benefits is vital. This article will address this question in detail, examining eligibility criteria, income limits, and strategies for maximizing benefits.

At what age can you earn unlimited income on Social Security?

Individuals can earn unlimited income without any reduction in Social Security benefits once they reach their full retirement age (FRA). For those born in 1960 or later, the FRA is 67 years old. Before reaching FRA, your benefits may be reduced if you exceed certain income limits.

Understanding Social Security Benefit Reductions

Social Security has specific income thresholds for individuals who retire early, before reaching their FRA. Here’s a brief overview of how earnings can impact your benefits:

- If you claim benefits before your FRA and earn more than $21,240 in 2023, Social Security will deduct $1 from your benefits for every $2 earned over this limit.

- In the year you reach your FRA, the limit increases to $56,520 for the months before you reach that age. For every $3 earned over the limit, $1 will be deducted from your benefits.

The following table summarizes these income limits and reductions:

| Age Category | Income Limit (2023) | Benefit Reduction |

|---|---|---|

| Under Full Retirement Age (FRA) | $21,240 | $1 deducted for every $2 |

| Year Reaching FRA | $56,520 | $1 deducted for every $3 |

| At or After Full Retirement Age (FRA) | Unlimited | No reduction |

Full Retirement Age: What You Need to Know

Full Retirement Age is the age at which individuals can receive their full Social Security retirement benefits without any deductions for excess earnings. As mentioned, for those born in 1960 or later, the FRA is set at 67 years old. Here’s a breakdown of the FRA for different birth years:

| Birth Year | Full Retirement Age |

|---|---|

| 1937 or earlier | 65 years |

| 1938 | 65 years, 2 months |

| 1939 | 65 years, 4 months |

| 1940 | 65 years, 6 months |

| 1941 | 65 years, 8 months |

| 1942 | 65 years, 10 months |

| 1943-1954 | 66 years |

| 1955 | 66 years, 2 months |

| 1956 | 66 years, 4 months |

| 1957 | 66 years, 6 months |

| 1958 | 66 years, 8 months |

| 1959 | 66 years, 10 months |

| 1960 or later | 67 years |

Strategies for Maximizing Social Security Benefits

Many individuals seek ways to enhance their Social Security benefits. Here are some strategies to consider:

- Delay Claiming Benefits: Waiting until after your FRA to claim benefits can increase your monthly benefit amount. For each year you delay past your FRA, your benefit can grow by approximately 8% per year, up until age 70.

- Estimate Your Earnings: Keep track of your income and estimate your Social Security benefits using the Social Security Administration’s (SSA) online calculators. This can help you determine the impact of claiming early or late.

- Consider Spousal Benefits: If you are married, investigate spousal benefits that may provide additional income. Spouses can claim up to 50% of their partner’s benefit if it is higher than their own.

- Plan for Healthcare Costs: As you approach retirement age, consider how healthcare costs may impact your financial planning. Medical expenses can significantly affect your retirement income.

- Invest Wisely: Diversifying investments and understanding the balance between risk and return is crucial. This helps ensure a steady income stream in retirement.

Important Considerations

While the possibility to earn unlimited income at full retirement age may seem appealing, there are several factors to keep in mind:

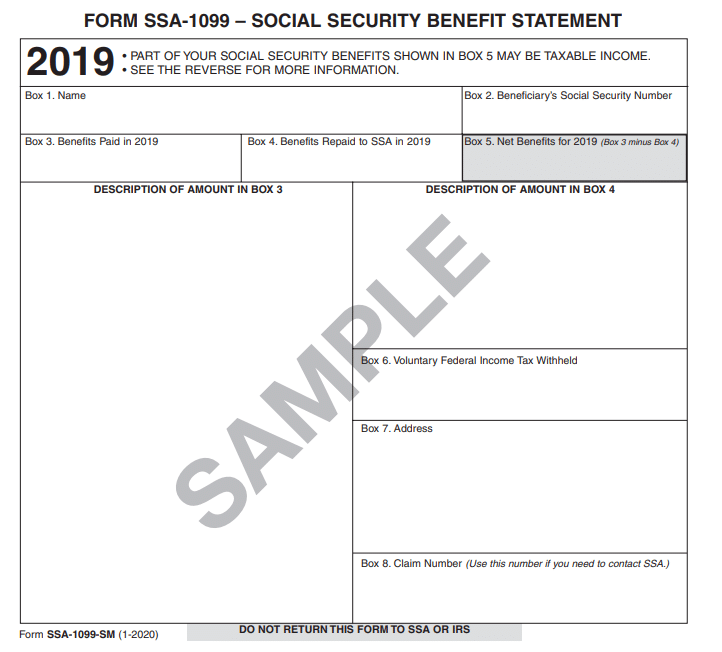

- Tax Implications: Social Security benefits may be subject to federal income tax if your total income exceeds certain thresholds. For individuals with provisional income over $25,000 and married couples over $32,000, part of your benefits may be taxable.

- Impact on Other Benefits: If you receive additional assistance, such as Supplemental Security Income (SSI), additional income could affect your eligibility for these programs.

- Insurance and Health Care: Consider whether you’ll still need health insurance coverage once you retire. If you plan to continue working part-time while receiving benefits, ensure that you have the necessary coverage.

Conclusion

Determining when you can earn unlimited income on Social Security is essential for those planning their retirement. Upon reaching full retirement age, individuals can earn without restrictions on their Social Security benefits. For those considering early retirement, careful planning and understanding of income limits can make a significant difference in financial outcomes.

As you approach retirement, assess your unique circumstances, seek advice from a financial advisor, and align your decision-making with your long-term goals. Everyone’s financial situation is different, and making informed choices is key to maximizing your benefits while enjoying the freedom of unlimited income.