Way back in 1848, James W. Marshall found gold at a sawmill in California and sparked a crazed ‘gold rush’ that would see an estimated 300,000 people descend on the town of Coloma, armed with spades, dynamite and anything else they could get their hands on.

Some got lucky and found gold nuggets of their own, while others found absolutely nothing – destroying their hopes and dreams while decimating the previously settled local communities.

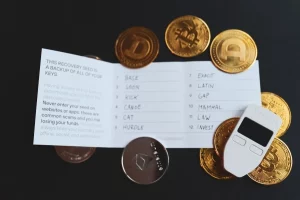

It’s often worth reflecting on the California Gold Rush when considering new and exciting technologies like cryptocurrency and NFTs, because all that glitters is not always gold. There is no such thing as guaranteed profit for traders, and for all the safe crypto brokers, there are those that are simply out there to scam their clientele and make a quick buck.

For newcomers to crypto trading, or to online trading in any guise, it can be easy to get wrapped up in the excitement of things while losing sight of common sense and logic – this is how scams and fraud are able to flourish.

For all the positives that cryptocurrency has brought to the way that many of us manage our finances, there’s plenty of negatives too – scammers taking advantage of well-meaning but naïve folk looking to make the most of a ‘gold rush’ of their own.

Common Crypto Scams

The first thing to note is that cryptocurrency holdings are, typically, not backed by the same protective and restitution measures that govern other forms of financial investment. So if you are the victim of fraud, it can be very difficult indeed to rectify the situation.

So the better tactic is to spot scams ahead of time, and the ‘good news’ is that those intent on committing fraud often make the same mistakes, ensuring that they are somewhat easier to spot.

The Promise Of Untold Riches

One of the most common traits of crypto scammers is to promise very high, and sometimes even guaranteed, returns on your investment. Visit bitcoin era app for more Information.

Such promises are, of course, nonsense. Nobody can completely accurately predict the way that Bitcoin and other currencies will trade, and trading is pure speculation on their price movements – fundamental and technical analysis helping to make that guesswork slightly more educated.

Scammers try to entice their victims with promises of untold riches that somehow allow you to cut corners and enjoy instant profit – and all you have to do is invest $X,XXX in some fraudster’s ‘service’. This is the gold rush mentality that still exists in crypto a decade or so after Bitcoin started to enjoy prominence.

Remember, if it seems too good to be true, it usually is.

The ICO Grift

For the uninitiated, new cryptocurrencies are usually fed into the market first via an Initial Coin Offering (ICO) – like an Initial Public Offering (IPO) for the issuance of stocks and shares.

These can be released to much fanfare, with scammers presenting ridiculous price projections for their coin and, essentially, lying about its use and viability.

To avoid being swept up in an ICO scam, you should do as much research as possible before investing a single dollar into these schemes. Go beyond just reading the white paper – what else are trusted sources in crypto saying about this new coin?

You should even try and reach out to the coin’s founder via social media, email, etc. Put them under the microscope and ask tough questions about their intent – the answers will often prove illuminating.

The Broker Scam

If you are going to invest in and trade crypto, you will, of course, need a platform via which to do so.

And another type of scam to watch out for that is the broker who will take your fiat money and promise to exchange that for the currency of your choosing.

Some broker scams literally involve fraudsters taking your money and disappearing – knowing that there’s no comeback because, in this unregulated space, they don’t need a license to set up their bogus company.

Other broker scams are more nuanced. There will be a legitimate enterprise, but these will bake their bad vibes into the mix in subtler ways – extortionate commissions, crazy overnight holding fees, charges upon withdrawals and that sort of thing.

If you want to trade crypto via a broker, you should do your due diligence on the company in question in advance. Our tip is to only trade with a broker that is licensed, has been around for a few years and offers the ability to trade other assets like stocks, ETFs and the like.

Those three factors alone will greatly diminish your chances of being embroiled in a scam.