In agreement with a study done by Wells Fargo inquiry, robots will lead to the loss of 200000 jobs in the banking world within the next decade.

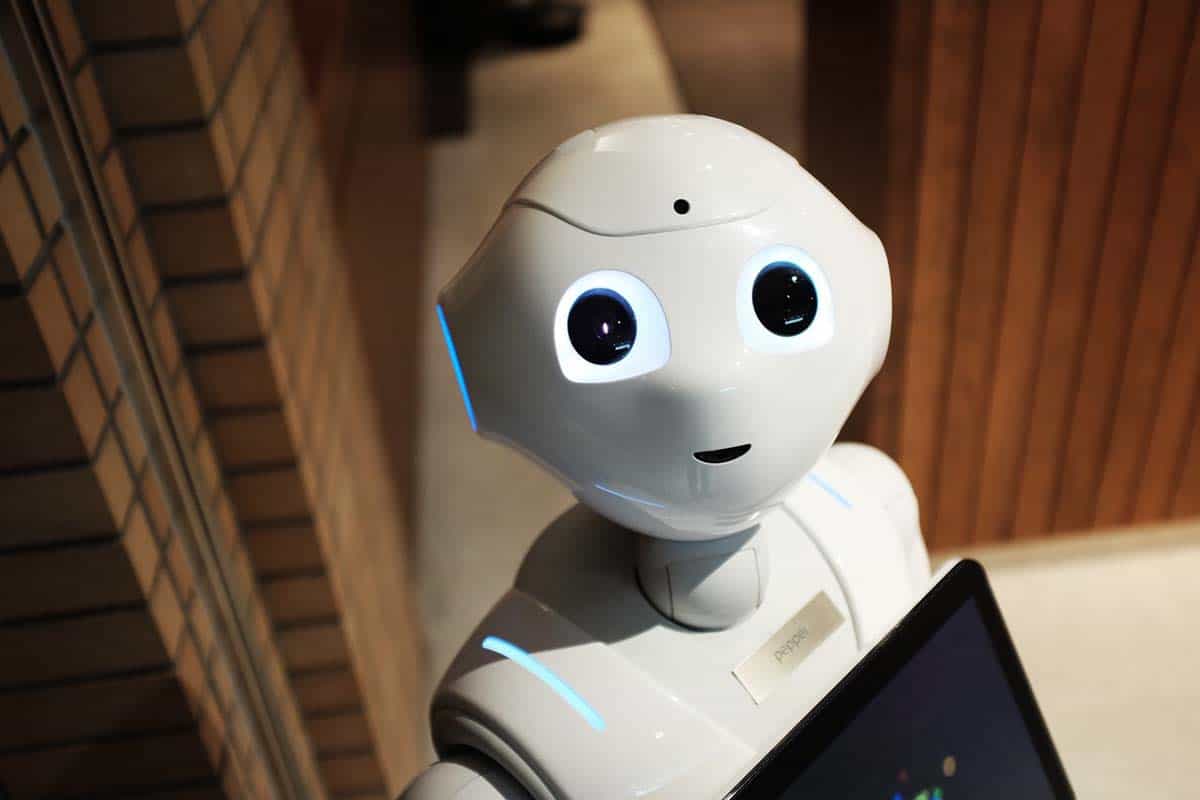

These figures appear to be astonishing and bewildering. nevertheless, the robot overhaul has been in view for a while now .although others use the terminology “robots” it’s the same as words such as artificial intelligence, advanced technology, and sophisticated software.

Just like other business sectors, banks are under assault from different factors working against them. The present inclination of low and undesirable interest rates is a negation of their business style. When rates are on the low sides, the bank’s yields are reduced to the extent of making profit difficult.

Loaning is one of the highest income generation sections of most banks. When this section is pressurized, it becomes a bad omen to other sections of the banks.

Banks are afraid of a multitude of different agents, including how the period of stock market surge will come in a bland recession or a worse case. The fright of a feasible recession may control future business enterprises.

Trade and tariff wars, nasty politics, climate control, a recent poor state of controversial IPOs, Brexit, Fintech disruptors, low trading volumes, and geopolitical uncertainty and tensions all contribute to the damages.

Unlike different industries, banks are not dragged down by with high-cost factories, manufacturing plants or display rooms full of expensive cars.

Banks’ biggest spending is on its employees. If there can substitute humans with robots and technology, while still in business the profit margin may increase.

From a busy environment filled with different banks with tellers and staff to the closing of the business. As a result of the customers becoming more adapted to online banking, the necessity to acquire buildings and staffs in every branch has been eliminated.

Following the study made by Boston consulting group, a management consulting firm a recent study shows that the improvement made in robotics and technology allows the business to execute a difficult task at a better and effective rate.

Robotic staffs have plenty of advantages to the banking firm because while a human employee requires holidays, sick leaves, restroom breaks, insurance and health benefits. Robots don’t require all these.

The prices of these robotic technologies have drastically reduced by 40% over a short period. It cost less for banking firms to install and use these technologies. It requires an initial cost fix, some upgrades, maintenance, and supervisions, contrary to banks paying staff and provides them with cost benefits constantly.

At larger banking firms highly paid staffs have already been substituted by technology. According to a report made by Marty Chavez formerly the co-head of the securities branch of Goldman, Sacks states that traders on wall street will soon need coding skills to succeed.

Previously traders on Wall Street with the capacity to bear risks and barely with a college degree could make a little fortune. Goldman’s so-called “tech Evangelist “preached to make money, capital and risk programmable by mixing traditional investments and technologies.

Mike Mayo a senior analyst at Fargo securities and the writer of the report states that banking firms will reduce their workforce and introduce robots to usher in the golden age of banking.

Staff with technical knowledge in the application of banking technology won’t be affected by the job cut. Example include senior python engineers, AI architects, etc

According to research made by economists at Federal Reserve Bank, banking automation has reduced national income paid to workers for over 20 years.

Soon the automation trends will spread to other business sectors.

You May Like These Articles As Well: